Dispatch from the Edge - July 2024

Can't stop the cutting edge

After a break, hello everyone! We are still going! Thanks for sticking with Alpha on the Edge during that hiatus.

We even saw some new subscribers, which is very humbling. Welcome to our new members!

As a reader, it’s always hard to know if a lapsed publication is a going concern, so actually subscribing or following during a lapse is very generous leap of faith. Truly - thank you all!

We could talk about life getting in the way and other details as explanations, but there are more exciting things to share with you all. Projects have been moving forward. Useful research is on the way. This dispatch will outline these developments and give you a better idea of what to expect from Alpha on the Edge.

This dispatch will focus on three topics:

Extending R2T Backtests with robust walk-forward optimization

Making more room for bespoke AI research

Launching Market Driver Insights

Onward and upward!

Extending R2T Backtests with robust walk-forward optimization

The Really, Really Thorough Backtests have covered a lot of very fruitful ground. We have looked at literally millions of simulations of different trading algorithms across hundreds of securities. This research is one of the best ways to answer the question “Does this trading strategy actually work?”

But there is always room for improvement. The research so far has mostly used randomized cross-validation, meaning that in-sample and out-of-sample subsets are selected randomly from historical time series. This works very well but has drawbacks. Many randomized splits select subsets where trading strategies have no trades or very few trades to build metrics from. (To clarify: The research published here filtered out those simulations that weren’t useful.)

There are a number of ways to address this - alternative randomized sampling strategies or extended data time series, for example.

But for daily frequency time series, walk-forward optimization is a very elegant and more interpretable framework for backtesting. It gives a higher percentage of useful simulations while maintaining robustness in results.

The R2T Backtests now have pipelines for both randomized cross-validation and walk-forward optimization. This gives us the ability to be flexible and gives more avenues for research. There won’t be any less transparency - the research published here will continue to disclose which method is used.

Making more room for bespoke AI research

A lot of our published research has focused on rules-based trading strategies using technical indicators. We have not left a lot of room for experimenting with strategies built from deep learning and neural networks.

There’s a good reason for this. Building, tuning, and testing neural networks is extremely difficult and time-consuming. Neural networks can be unstable and unpredictable, and deploying them in a standardized “production”-style pipeline requires a large amount of computational resources and judgement calls.

But here’s the thing: It’s also very, very rewarding. This is the area that I always want to focus on more because of how powerful these models are and how quickly the field is developing, especially in finance.

There’s never enough time in the day. I still feel very strongly that the ability to run millions and millions of simulations is a valuable service. It exposes the real truth behind a lot of trading strategies. The problem is that scaling neural nets to that level is simply not possible without far more advanced technology. (Hopefully someone can tell me when I can get access to quantum computing!)

So the solution is to compromise! While building a modular WFO pipeline, I built more standardized components. A lot of the past projects required custom builds because of very bespoke research questions. This gave less time for the AI models.

Now, we can still share useful results from R2T Backtests, and rest assured, that content will not become boilerplate charts. The framework is far too valuable to stop custom research.

And this is great because I really, really want to play with Temporal Fusion Transformers….

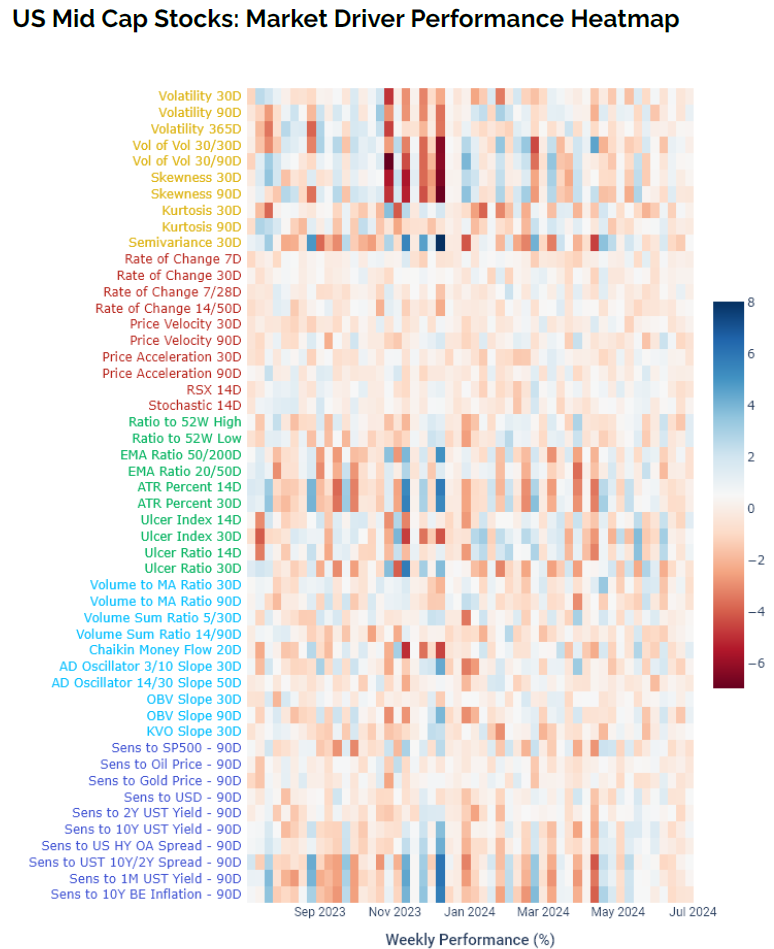

Launching Market Driver Insights

The bulk of our recent posts have gone in-depth with factor research, or what we call market drivers. Market drivers have many powerful insights for traders and investors, but good content is not easily available outside of large financial institutions.

To fix this, we launched Market Driver Insights. This is a weekly publication with extensive analysis of market drivers and macroeconomic factors. It covers US equity markets and cryptocurrencies. The content on Market Driver Insights goes well beyond what was published here.

Here’s an example of the new tools:

So if you found market drivers a useful tool, consider subscribing to Market Driver Insights.

To wrap this up, thanks again for sticking with Alpha on the Edge! We’ll be back with more research and look forward to sharing our work with you all.

Until next time, keep on the cutting edge, everyone.