Let's test every moving average crossover algorithm

The final word on the MA crossover?

We have spent a fair amount of time bashing the humble moving average. In our backtesting so far, the MA crossover strategy has shown no real value as a standalone trading strategy. And when we tested a popular variant - the exponential moving average crossover - we found little to recommend it, either.

Even still, moving averages are a very, very popular tool for all kinds of trading strategies. Do any of them help the crossover strategy?

We can answer this question by looking at every moving average and backtesting standalone crossover strategies for each one.

(… well, not every moving average, but we have 18 different MAs. So we have a very, very good representation of MA variations.)

The Moving Average Zoo

MAs are extremely helpful for smoothing high-noise time series into a discernible signal. They aim to balance responsiveness to price moves with representing the series movements accurately. We are testing a specific use of MAs here, but they have many more functions such as signal confirmation and trend identification. We will explore those uses in later posts.

For this test, we used our backtesting methodology with 28 FX pairs (the FX majors) and 18 different MAs. Here are the MAs with links to definitions:

Simple Moving Average (SMA)

As you can see, this is a veritable zoo of MAs. It’s hard to tell which are gimmicks and which are legitimately useful until we see empirical results, so let’s look at the backtests!

Backtest Results for 18 Moving Averages

We evaluated 18 MA crossover strategies using version 1 of our methodology. We are looking for more than profitable strategies. Our testing looks for strategies that are robust and consistent across different market environments. Weak live performance is the enemy.

A brief recap of the strategy:

We define a “fast” MA and a “slow” MA. The fast MA has a shorter lookback window.

When the fast MA crosses the slow MA from below, the algorithm generates a buy signal. We cover any short position and go long.

When the fast MA crosses the slow MA from above, the algorithm generates a sell signal. We close any long position and go short.

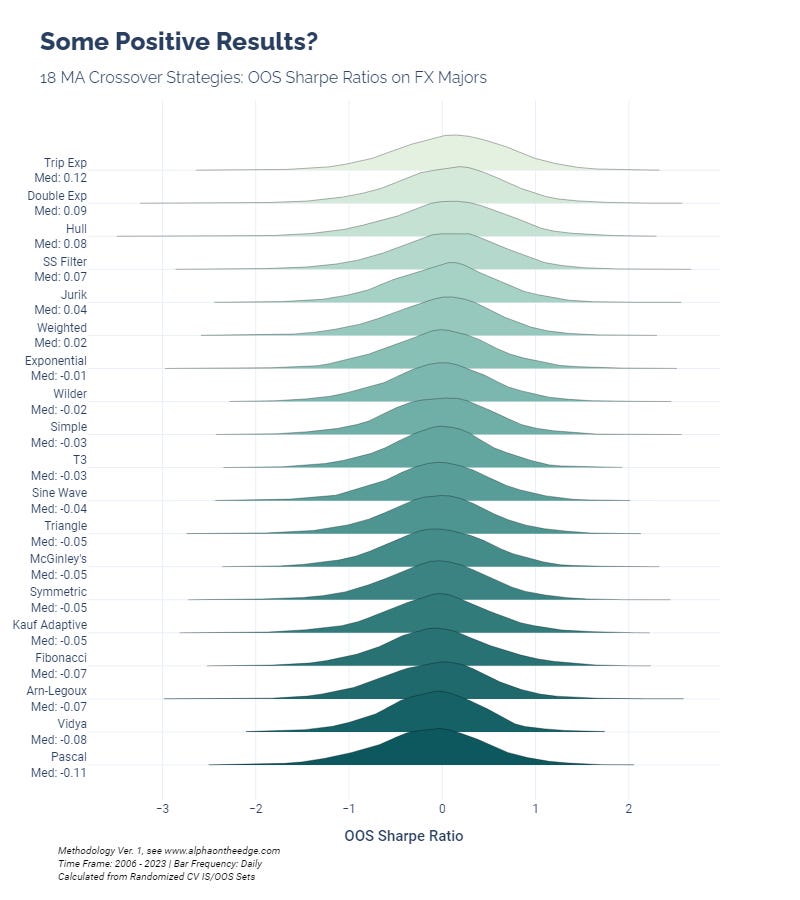

Strategy Sharpe ratios conveniently summarize results:

The median Sharpe ratios for the 18 MAs vary from 0.12 to -0.11. The triple exponential moving average (TEMA) had the highest median OOS Sharpe ratio, while the Pascal’s Triangle Weighted Moving Average had the lowest median OOS Sharpe ratio.

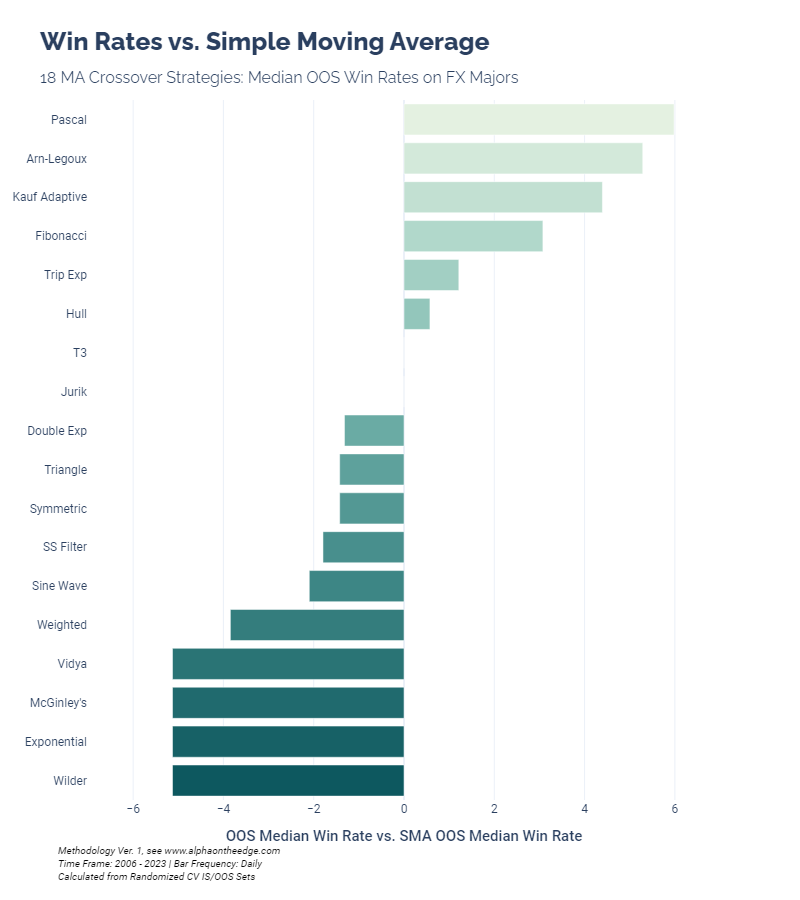

Statistically, none of the MAs stand out in terms of Sharpe ratios. However, you’ll notice that the Simple Moving Average crossover, the basis for all MA crossovers, is roughly in the middle of the pack. In a way, this is the crux of our study - what MA variations are better than the SMA?

5 of the 18 MAs outperform the simple moving average. The Pascal-weighted average looked bad according to Sharpe ratios, but not according to the win rate. This tells us that the PWMA tens to flag poor risk-adjusted trades but outperforms on an absolute basis.

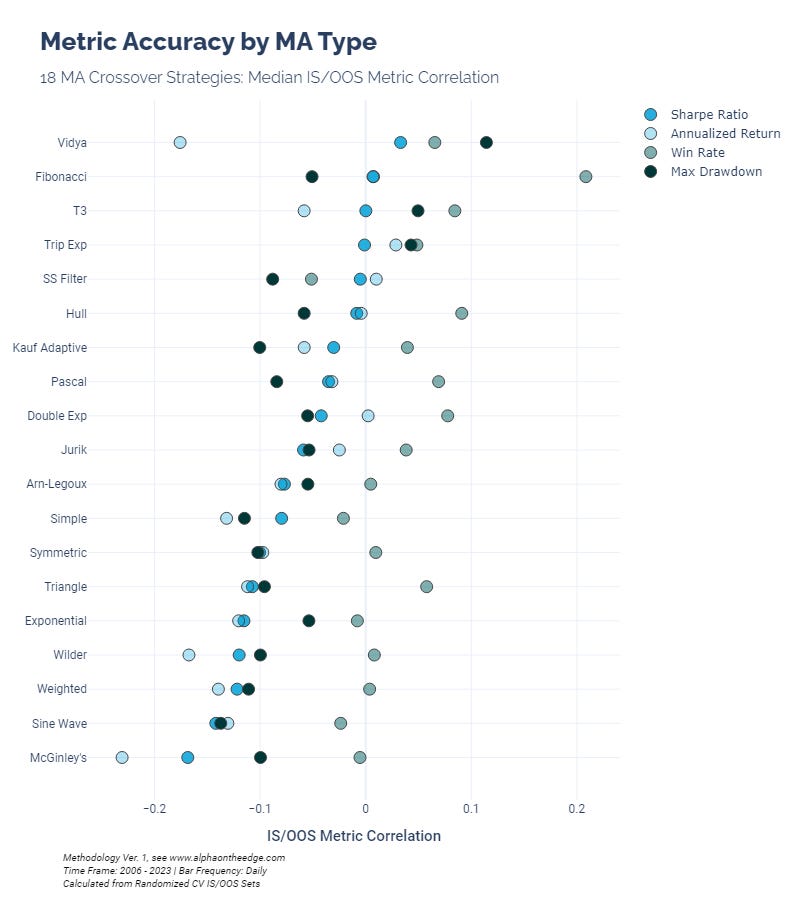

Our backtesting methodology also looks at what we call “Accuracy,” which we define as the correlation between in-sample and out-of-sample results. We want predictable results when a system goes into live trading, after all. Here are the median IS/OOS correlations for four metrics on the 18 MAs, sorted by Sharpe Ratio correlation:

Most of the MAs have low/negative IS/OOS correlations for all metrics, which means that their optimal crossover strategy results have historically not generalized well.

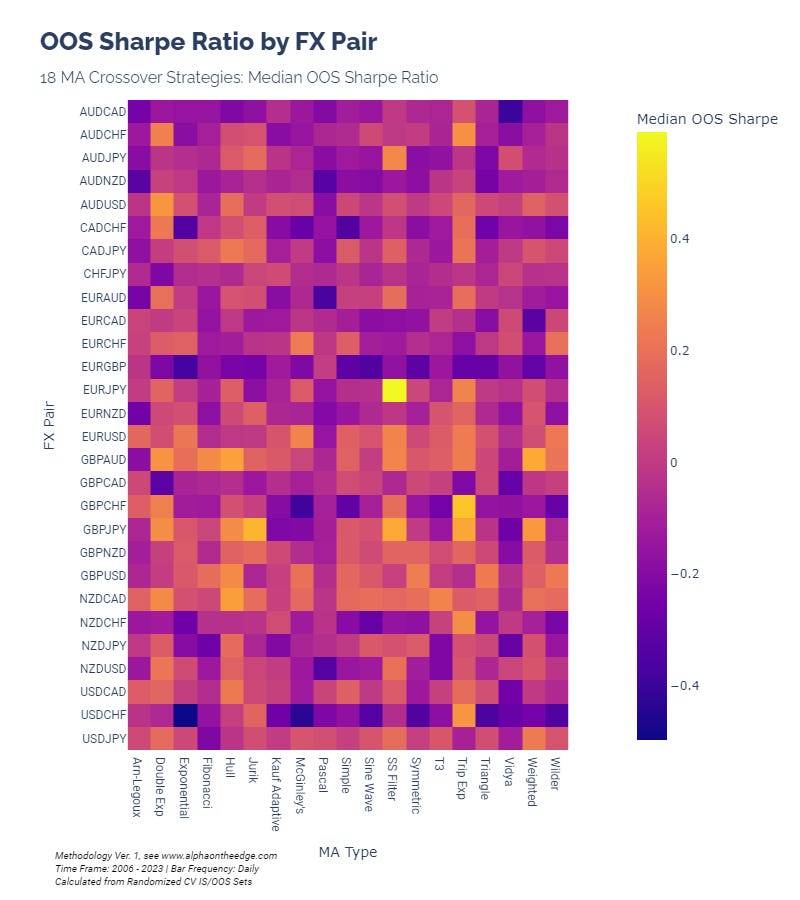

Finally, we are also interested in result differences among the 28 FX majors. Maybe one average works well for one pair but not others:

Indeed, Ehler’s SSF stands out on EURJPY, which is extremely interesting. Might be worth investigating in a future post.

MA Crossovers - Conclusion

In this and previous posts, we have used the MA crossover strategy as a punching bag. MAs have many uses, and the standalone crossover trading strategy is a popular illustration of algorithms. It turns out that none of our empirical evidence supports usage of this strategy so far.

We will not abandon MAs altogether. Indeed, we plan to use MA confirmation on reversal algorithms, trend following, etc. This analysis should not make everyone abandon MAs altogether!

But we can definitively close the book on the MA crossover trading strategy and move on to other, more interesting algorithms.

Until next time, keep on the cutting edge, everyone.

Resources:

Disclaimers

The content on this page is for educational and informational purposes only. Any views and opinions expressed belong only to the writer and do not represent views and opinions of people, institutions, or organizations that the writer may or may not be associated with.

No material in this page should be construed as buy/sell recommendations, investment advice, determinations of suitability, or solicitations. Securities investment and trading involve risks, and not all risks are disclosed or discussed here. Loss of principal is possible. You are encouraged to seek financial advice from a licensed professional prior to making transaction decisions.

Further, you should not assume that the future performance of any specific investment or investment strategy will be profitable or equal to corresponding past performance levels. Past performance does not guarantee future results.